A Limited Liability Company (LLC) is a business structure that offers a unique blend of benefits, making it the preferred choice for founders looking to minimize risk and protect their personal assets. Unlike sole proprietorships and partnerships, LLCs provide a layer of liability protection, shielding owners from personal responsibility for the debts and liabilities of the business. This means that in the event of legal action or financial difficulties, the personal assets of the LLC’s owners—such as their homes, savings, and investments—are generally protected from being used to satisfy business debts or legal judgments.

Additionally, LLCs offer flexibility in management and taxation. Owners, known as members, have the freedom to choose how they want the company to be taxed, whether as a sole proprietorship, partnership, S corporation, or C corporation. This flexibility allows founders to optimize their tax situation and adapt to changing business needs over time. With these advantages, it’s no wonder that LLCs have become the business entity of choice for entrepreneurs seeking to safeguard their assets while maintaining operational flexibility.

Our Services

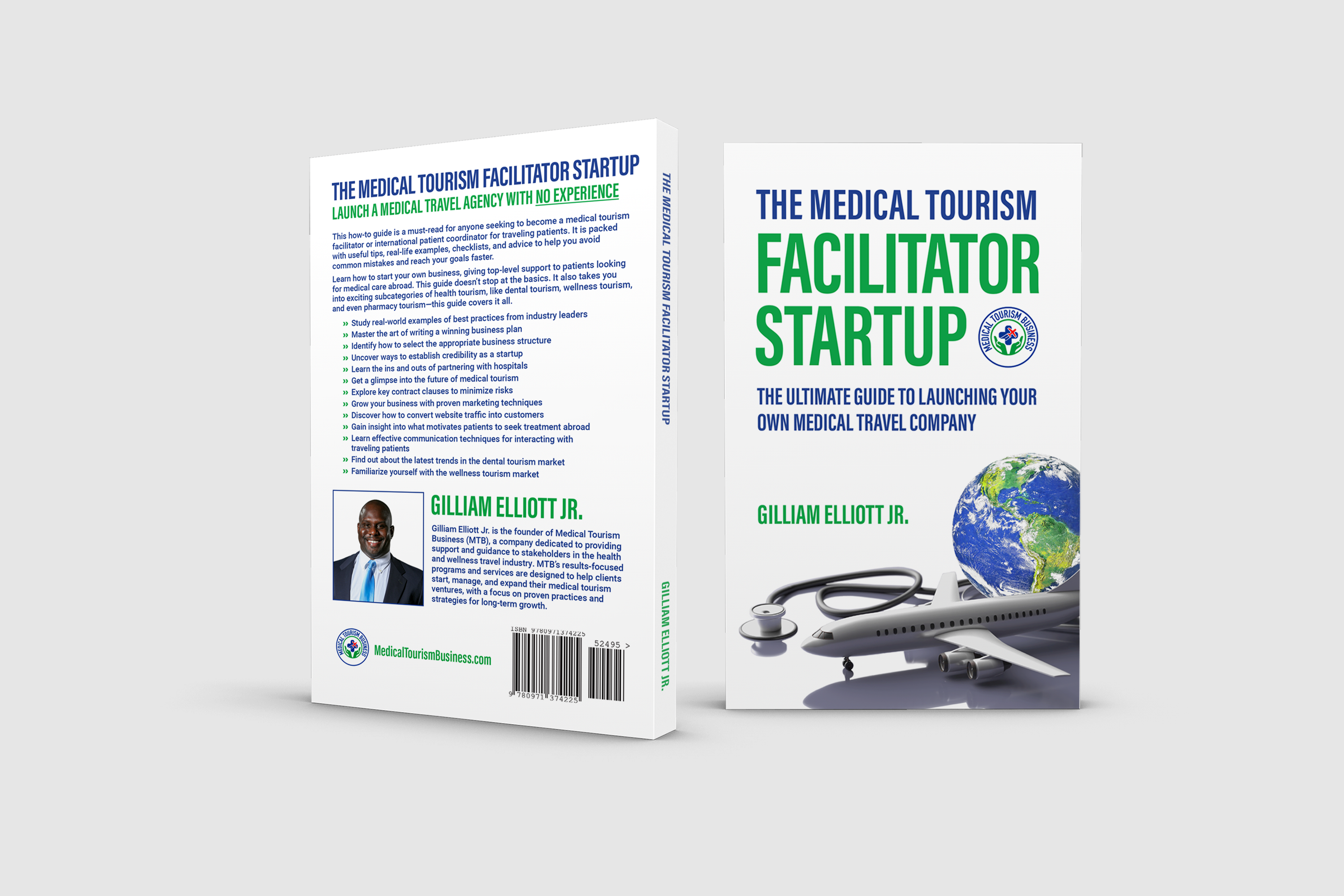

At Medical Tourism Business, we specialize in assisting founders like you in establishing their LLCs quickly and efficiently. Our comprehensive suite of services is designed to streamline the process of LLC formation, allowing you to focus on what matters most—building and growing your business.

- U.S. LLC Registration: Let us handle the intricacies of registering your LLC with the appropriate state authorities, ensuring compliance with all legal requirements.

- State Filing Fee Included (Covers One Year): Our LLC filing service simplifies your business formation by including the state filing fee. Every US entity must pay an annual filing fee to remain active and in good standing. This fee varies by state and entity type, covering the cost of processing your business’s annual report and maintaining its legal status.

- For Non-U.S. Citizens: Our services are designed to help both U.S. and non-U.S. citizens establish their LLCs in the United States. Please note that for non-U.S. residents, there is an additional fee and a few extra steps required to complete the process.

- EIN for Tax and Banking Purposes: Obtain an Employer Identification Number (EIN) from the IRS for tax and banking purposes, essential for conducting business in the U.S.

- Delivered in 10 Business Days: Experience swift and efficient service with our LLC formation, completed and delivered to you within 10 business days.

With MTB, you can trust that your LLC formation process will be handled with expertise, efficiency, and attention to detail, allowing you to embark on your entrepreneurial journey with confidence and peace of mind.